Understanding Student Loan Forgiveness: The IBR Plan Explained

The rising cost of education has left many graduates burdened with significant student loan debt. As the conversation surrounding student loan forgiveness gains momentum, it is essential to understand the Income-Based Repayment (IBR) plan and its implications for borrowers seeking relief from their financial obligations. This article delves deep into the details of the IBR plan, providing insights into how it works, qualifications, benefits, and its potential for forgiveness.

What is the Income-Based Repayment (IBR) Plan?

The Income-Based Repayment plan is one of several repayment options available to borrowers under federal student loan programs. Implemented to make loan payments more manageable, the IBR plan adjusts a borrower’s monthly payment based on their income and family size. This plan aims to prevent financial hardship for borrowers in the years following graduation.

How Does the IBR Plan Work?

The IBR plan is particularly beneficial for borrowers who have a high amount of federal student loan debt relative to their income. Here’s how it works:

- Monthly Payments: Under the IBR plan, borrowers pay 10-15% of their discretionary income towards their loans, depending on when they took out their loans. Discretionary income is defined as the difference between your adjusted gross income (AGI) and 150% of the poverty guideline for your state and family size.

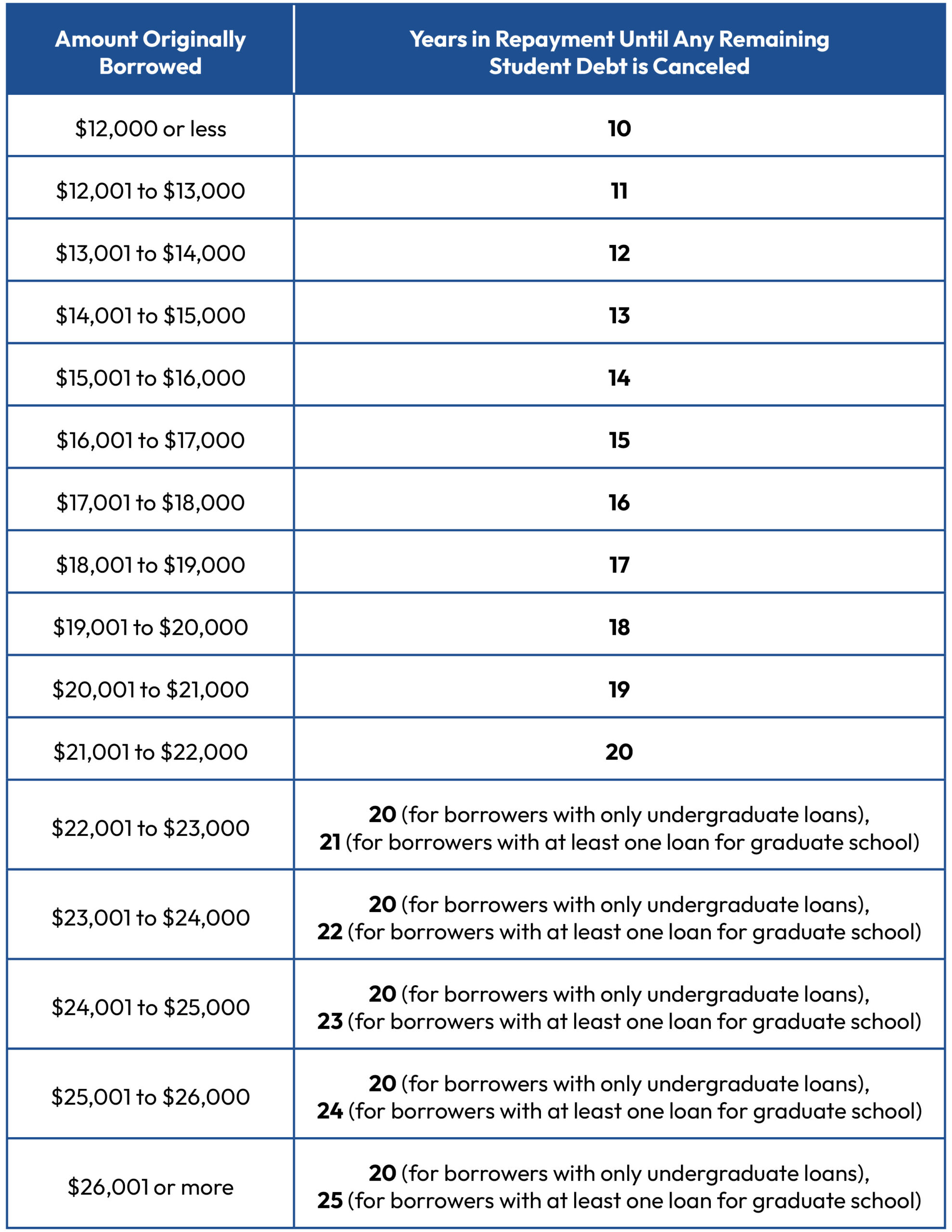

- Loan Forgiveness: After making consistent payments for a specified period (usually 20 years for new borrowers), the remaining loan balance may be forgiven. This can provide significant relief for those who find themselves struggling to pay off their student loans.

- Eligibility: To qualify for the IBR plan, borrowers must have a partial financial hardship, meaning that their monthly payments under the standard repayment plan would exceed what they would pay under IBR.

Eligibility Requirements for IBR

To determine if you qualify for the IBR plan, consider the following conditions:

- You must have federal student loans.

- You must demonstrate financial hardship.

- You can apply for the plan at any time, but if you want the lower payment amounts, you need to do so before your payment is due.

Advantages of the IBR Plan

The IBR plan offers several advantages:

- Affordability: Payments are capped based on income, making them more accessible.

- Loan Forgiveness: After completing the required payment period of 20-25 years, remaining loan balances may be forgiven.

- Protection from Default: By enrolling in IBR, you lower the risk of defaulting on your student loans, which can have substantial repercussions for your credit score and financial future.

How to Enroll in the IBR Plan

Enrolling in the IBR plan is a straightforward process:

- Visit the official Federal Student Aid website to find the application.

- Fill out the necessary documentation, including information about your income and family size.

- Submit your application, and your loan servicer will review your request and notify you of your eligibility.

Challenges and Considerations

Despite its benefits, there are some challenges and considerations borrowers should be aware of:

- Tax Implications: Any loan amount forgiven under the IBR plan may be considered taxable income. This can lead to a significant tax bill in the year forgiveness occurs.

- Changes in Income: If your income increases, your monthly payment under the IBR plan will also increase. This can be a double-edged sword, as many borrowers hope to see their income rise.

- Loan Type Restrictions: Only federal Direct Loans are eligible for the IBR plan. Private loans do not qualify.

Comparing IBR with Other Repayment Plans

The IBR plan isn’t the only repayment plan available to student loan borrowers. Other options, such as the Pay As You Earn (PAYE) Plan and the Revised Pay As You Earn (REPAYE) Plan, offer varying terms and conditions. Borrowers should evaluate each plan based on their specific financial situations to determine which aligns best with their needs.

Resources for Additional Help

For borrowers seeking advice and assistance with student loan debt, the [Student Loan Borrower Assistance](https://studentloanborrowerassistance.org/for-borrowers/dealing-with-student-loan-debt/loan-cancellation-forgiveness-bankruptcy/cancellation-forgiveness-options/idr-cancellation/) website offers valuable resources and guidance tailored to help individuals navigate their options for forgiveness and repayment.

Conclusion

Understanding the intricacies of the Income-Based Repayment plan can empower borrowers to make informed decisions regarding their student loan debt. With the potential for student loan forgiveness through this program, many may find relief from their financial burdens, allowing them to focus on their careers and personal lives. It is crucial for borrowers to actively seek assistance and explore all available options to make the best choices for their financial futures.