Understanding Income-Driven Repayment (IDR) and Student Loan Forgiveness

Student loan forgiveness programs have gained significant attention in recent years, providing hope for millions of borrowers burdened by educational debt. One of the most impactful initiatives in this domain is Income-Driven Repayment (IDR). This blog post will delve into student loan forgiveness through IDR, exploring how it works, its benefits, and the essential steps to qualify. This is crucial information for HR professionals and business leaders as they navigate the complexities of employee financial wellness programs.

What is Income-Driven Repayment (IDR)?

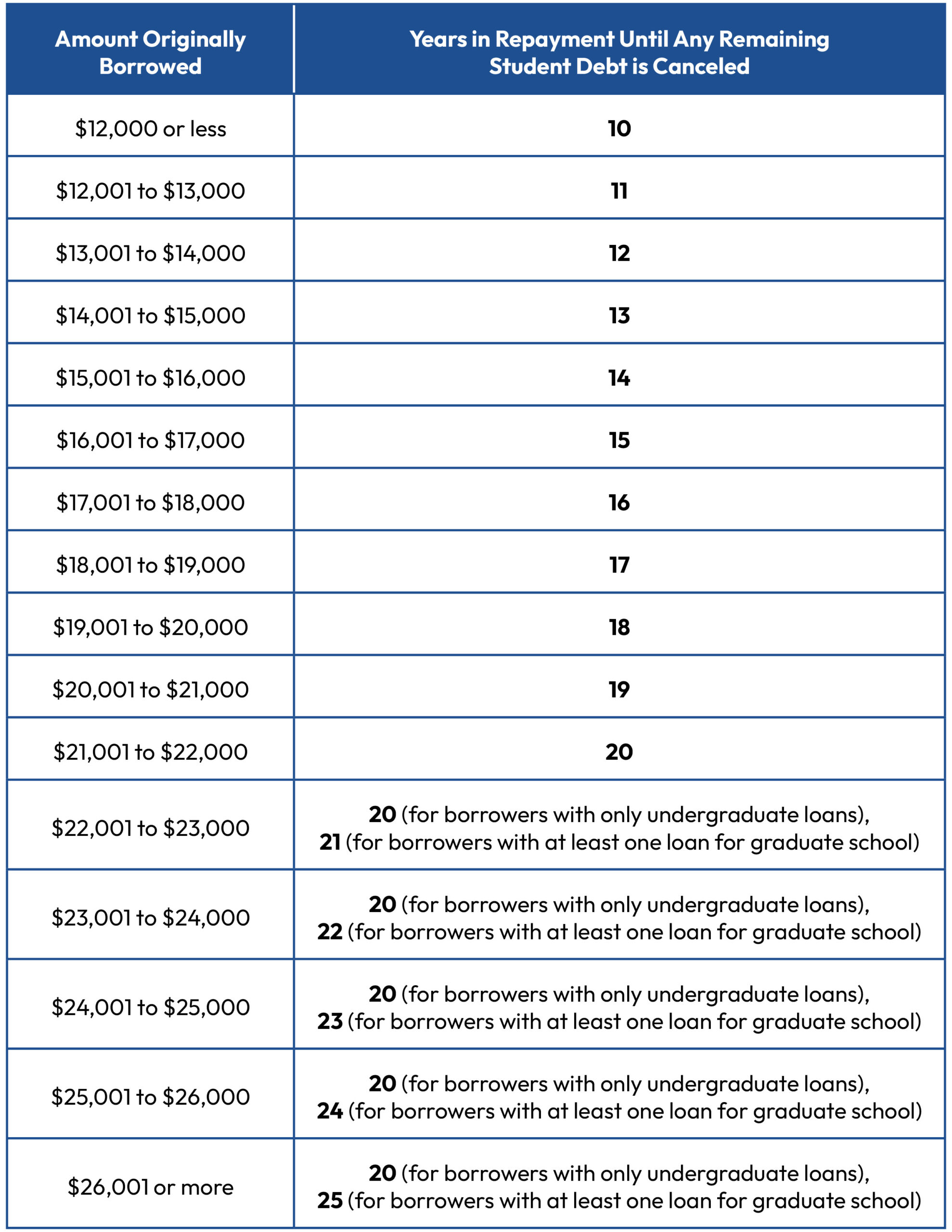

IDR plans are federal repayment options designed to make student loan payments more manageable by adjusting monthly payments based on a borrower’s income and family size. The main types of IDR plans include:

- Revised Pay As You Earn (REPAYE)

- Payments are capped at 10% of discretionary income.

- Borrowers may qualify for forgiveness after 20 years of qualifying payments for undergraduate loans or 25 years for graduate loans.

- Pay As You Earn (PAYE)

- Similar to REPAYE but requires a demonstration of financial hardship.

- Also offers forgiveness after 20 years.

- Income-Based Repayment (IBR)

- Payments are capped at 10% or 15% of discretionary income depending on when the loans were taken out.

- Forgiveness after 20 or 25 years of payments.

- Income-Contingent Repayment (ICR)

- Payments are based on the borrower’s income and can change each year.

- Forgiveness can occur after 25 years.

The Benefits of IDR Plans

One of the primary advantages of IDR plans is making student loan payments more affordable. For many borrowers, traditional repayment plans can be daunting, especially after transitioning into the workforce. IDR reduces the financial stress on borrowers, allowing them to allocate funds towards other essentials such as housing, savings, and more.

Furthermore, IDR plans can lead to loan forgiveness after a set number of qualifying payments, providing a clear pathway towards financial freedom. Keep in mind that forgiveness may have tax implications, so it’s essential for borrowers to understand the potential financial impact once their loans are forgiven.

Qualifying for IDR and Loan Forgiveness

Qualifying for an IDR plan requires meeting specific criteria, including:

- Having eligible federal student loans.

- Demonstrating financial hardship (specific to PAYE and IBR plans).

- Submitting a request to enroll in an IDR plan.

- Providing documentation of income and family size.

Importantly, borrowers must recertify their income and family size annually to maintain their IDR status. Failing to do so can result in recalculated payments, which may increase financial burden.

Navigating the Application Process

Applying for an IDR plan is a straightforward process, typically initiated through the loan servicer’s website or via a paper application. Borrowers should:

- Gather necessary financial documents (i.e., pay stubs, tax returns).

- Visit the relevant federal student aid website.

- Complete the application form, ensuring that all income and family size information is accurate.

- Submit documentation as directed by the loan servicer.

Once submitted, borrowers should expect a confirmation from their servicer, outlining their new payment plan, monthly payment amount, and the terms associated with the IDR plan.

Challenges and Considerations

While IDR plans offer considerable benefits, they also pose certain challenges that borrowers must be aware of. Importantly, borrowers must remain proactive in managing their loans:

- Loan Servicer Communication: Regular communication with loan servicers is vital. Borrowers should not hesitate to reach out with questions or concerns, particularly regarding loan status or payment changes.

- Understanding Potential Tax Implications: As mentioned earlier, loan forgiveness can have tax consequences. Borrowers may want to consult with a tax professional for personalized guidance.

- Staying Informed on Policy Changes: The landscape of student loan forgiveness is continually evolving. Borrowers must remain updated on any changes that could impact their IDR plans or forgiveness eligibility.

Conclusion: Empowering Borrowers through IDR

The emergence of IDR plans marks a pivotal shift in how borrowers manage student loans and seek forgiveness. For HR professionals and business leaders, understanding these options can inform support strategies for employees burdened by student debt. By fostering a culture of awareness and providing educational resources, organizations can significantly enhance the financial wellness of their workforce.

For additional information and support on student loan options, consider visiting Student Loan Borrower Assistance, which offers comprehensive insights into managing student debt and accessing relief programs.