What is Student Loan Forgiveness and How Does Income-Driven Repayment Work?

In recent years, the conversation around student loan forgiveness has gained immense traction, particularly with regard to Income-Driven Repayment (IDR) plans like Income-Based Repayment (IBR). These plans are designed to help borrowers manage their student loan payments according to their income, and they offer paths toward forgiveness of the remaining loan balance after a set number of years of qualifying payments.

The Basics of IBR: How It Works

Fortunately for borrowers, IBR is one of the types of IDR plans available. Under the IBR plan, monthly payments are capped at a percentage of the borrower’s discretionary income, which is defined as the difference between their annual income and 150% of the poverty guideline for their family size. This allows for more manageable payments, especially for those who may be struggling financially, and it encourages borrowers to stay on track without the risk of default.

Eligibility Criteria for IBR

To qualify for IBR, borrowers must have federal student loans. The eligibility for the plan also hinges on having a partial financial hardship, meaning the monthly payment under IBR must be less than the standard 10-year repayment plan. The eligibility criteria can be outlined as follows:

- The borrower must show financial need.

- The borrower must have eligible federal loans.

- The borrower must apply for IBR through their loan servicer.

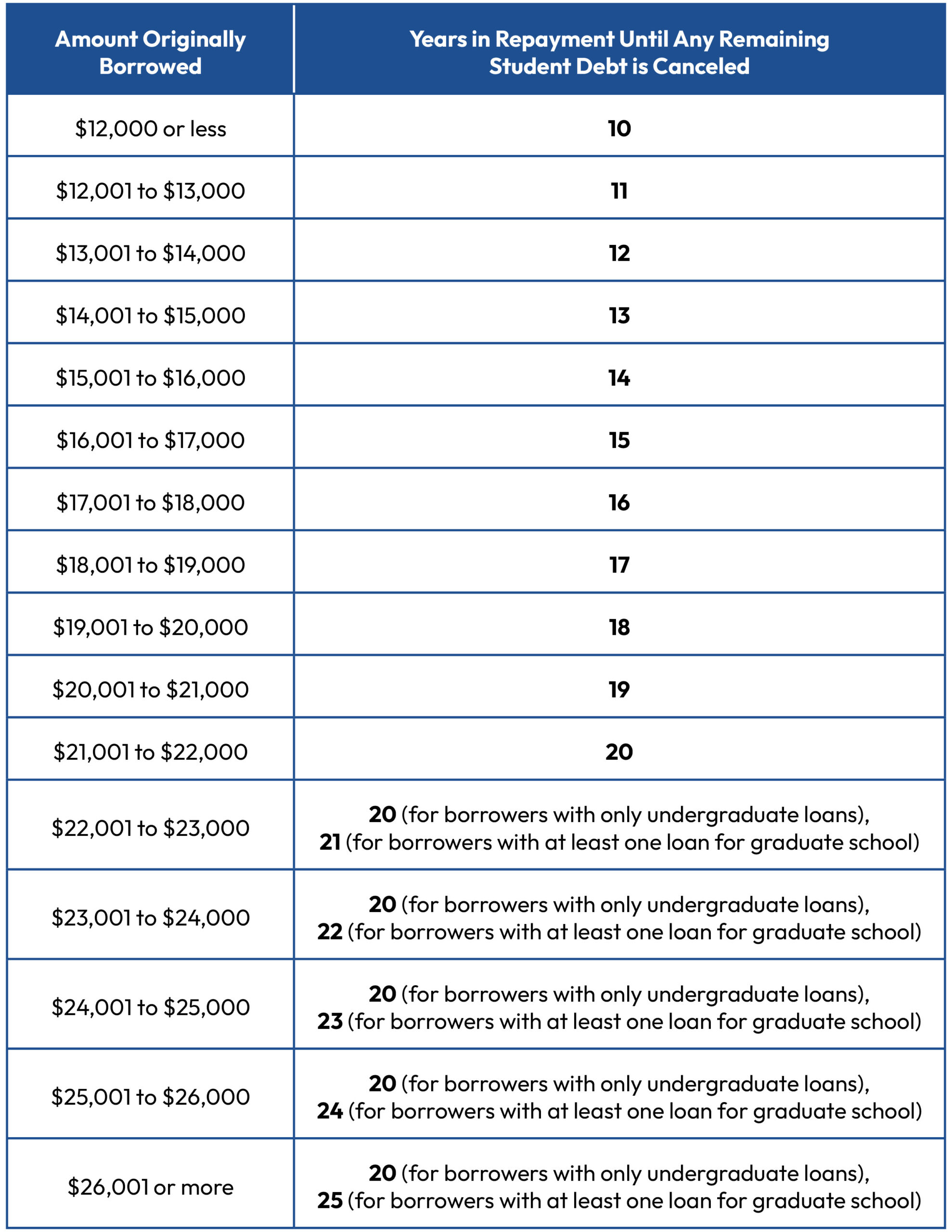

Loan Forgiveness through IBR

One of the most appealing aspects of IBR is the potential for loan forgiveness after 20 to 25 years of qualifying payments, depending on when the loans were taken out and whether they are new loans or older ones. For those on the IBR plan, the remaining balance can be forgiven after a period if they consistently make payments according to the terms of the plan.

The Application Process

Applying for IBR involves filling out the Income-Driven Repayment Plan Request form, available through the Federal Student Aid website. It’s crucial that borrowers provide accurate income information to ensure their payment calculations are correct. Borrowers must reapply every year to confirm their eligibility and update their income information.

Pros and Cons of IBR

While IBR offers many benefits, it also comes with certain drawbacks that borrowers should consider:

Pros:

- Lower monthly payments based on income.

- Potential for loan forgiveness after 20-25 years.

- Protection from collections during periods of economic hardship.

Cons:

- Interest may accumulate, resulting in a higher total loan cost over time.

- Tax implications on forgiven amounts.

- Annual recertification requirements can be cumbersome.

Alternatives to IBR

For those who may not find IBR advantageous, there are several alternatives to consider. Other IDR plans such as Pay As You Earn (PAYE) and Revised Pay As You Earn (REPAYE) also provide similar benefits with slightly different terms. Additionally, borrowers might explore Public Service Loan Forgiveness (PSLF), especially if they work in qualifying public service roles.

Student Loan Forgiveness: What to Know

It’s essential for borrowers to be aware of their repayment options and potential pathways toward forgiveness. Understanding student loan forgiveness options will enable them to make informed choices about their financial future.

Staying Informed: Register for Updates

Borrowers should stay informed regarding regulations and changes in federal student loan policies. Participating in seminars, webinars, and other informative resources can be crucial for understanding the landscape of student loans and forgiveness.

Conclusion

In conclusion, Income-Based Repayment (IBR) is a valuable option for borrowers facing challenges in managing student loan payments. By knowing the eligibility requirements, understanding the application process, and recognizing the potential for forgiveness, borrowers can take charge of their financial future. It is essential to utilize trusted resources and create a plan that aligns with their personal and financial goals—a step toward a debt-free life.