Understanding the Dow Jones: Key Insights into the Stock Market

The stock market serves as a barometer of economic health, and among its various indicators, the Dow Jones Industrial Average (DJIA) stands out as one of the most significant. This blog post delves into how the Dow Jones operates, recent trends affecting it, and implications for HR professionals and business leaders alike.

What Is the Dow Jones Industrial Average?

The Dow Jones Industrial Average is a stock market index that measures the stock performance of 30 large publicly-owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ. It was created by Charles Dow in 1896 and has since become a key indicator of market trends.

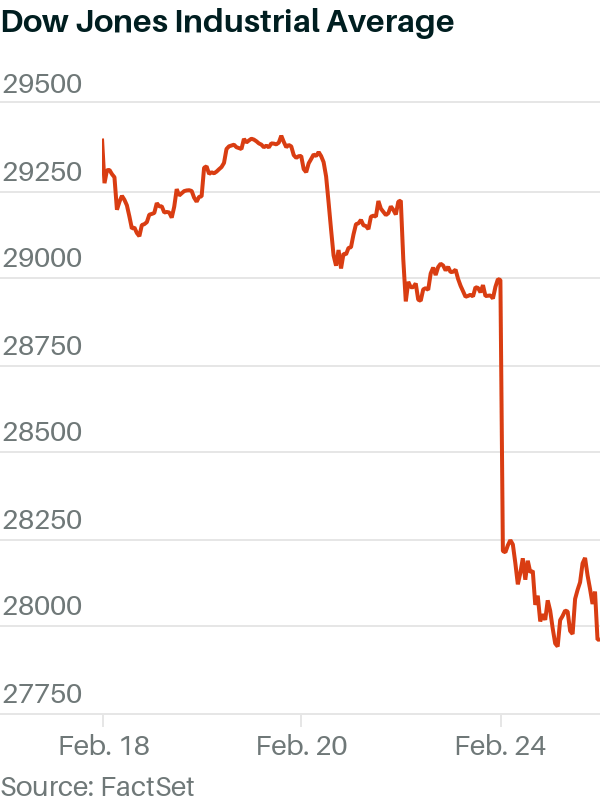

Recent Trends and Shocking Declines

As reported in a recent Barron’s article, the Dow Jones is set to drop significantly, driven by various factors such as inflation concerns, rising interest rates, and geopolitical tensions. These fluctuations offer critical insights into market dynamics that every business leader should be aware of.

Inflation’s Impact on the Dow Jones

Inflation has been a recurring theme in economic discussions, particularly as it affects purchasing power and, consequently, stock valuations. With the Federal Reserve raising interest rates in response to persistent inflation, many analysts predict a further decline in major indices, including the Dow Jones.

Rising Interest Rates and Market Volatility

Higher interest rates generally lead to increased borrowing costs for businesses, which can deter investment and slow economic growth. When interest rates rise, the cost of capital for companies also increases, leading to lower profitability, which can significantly impact stock prices.

Understanding Market Sentiment

Market sentiment often influences the stock market more than fundamental analysis. Investor fears about the economic outlook can lead to rapid sell-offs. Thus, keeping an eye on market sentiment is just as crucial as monitoring economic indicators.

Preparing for Market Fluctuations: Strategies for Leaders

Business leaders and HR professionals can leverage the knowledge about market trends to make informed decisions. Here are some strategies to consider:

- Diversify Investments: Diversifying your portfolio can help mitigate risks associated with stock market volatility.

- Improve Cash Flow Management: In times of economic uncertainty, maintaining strong cash flow is vital. Ensure your company is prepared for market fluctuations.

- Focus on Hiring for Resilience: Build a workforce that can adapt quickly to changing market conditions by prioritizing skills such as problem-solving and adaptability.

Leveraging AI Consulting for Investing Decisions

Given the complexity of the stock market, leveraging AI can be beneficial for making informed investment decisions. AI consulting can help businesses analyze vast amounts of market data more efficiently, enabling quicker and more accurate decision-making processes.

As AI continues to evolve, its applications in financial markets increase. With technological advancements, financial modeling and predictive analytics can provide leaders with substantial insights into future market conditions.

n8n Workflows: Automating Business Processes in Response to Market Trends

In addition to using AI for investment insights, businesses can streamline operations through n8n workflows. n8n allows organizations to automate repetitive tasks, ensuring that internal processes remain efficient even during times of market instability.

By automating data collection and reporting, HR professionals and business leaders can save time and focus on strategizing for the future. When reacting to changes in the stock market, being agile and responsive is critical.

Conclusion

The Dow Jones is not just a number; it signifies economic performance and influences business decisions across various sectors. By understanding its trends, incorporating AI consulting, and utilizing automation workflows, organizations can better prepare for the unpredictable nature of the stock market.

Whether you’re an HR professional looking to hire resilient talent or a business leader strategizing investments, staying informed about the Dow and broader market trends can enhance your decision-making processes. Embrace the tools at your disposal, adapt to the changes, and steer your organization toward success in any economic climate.