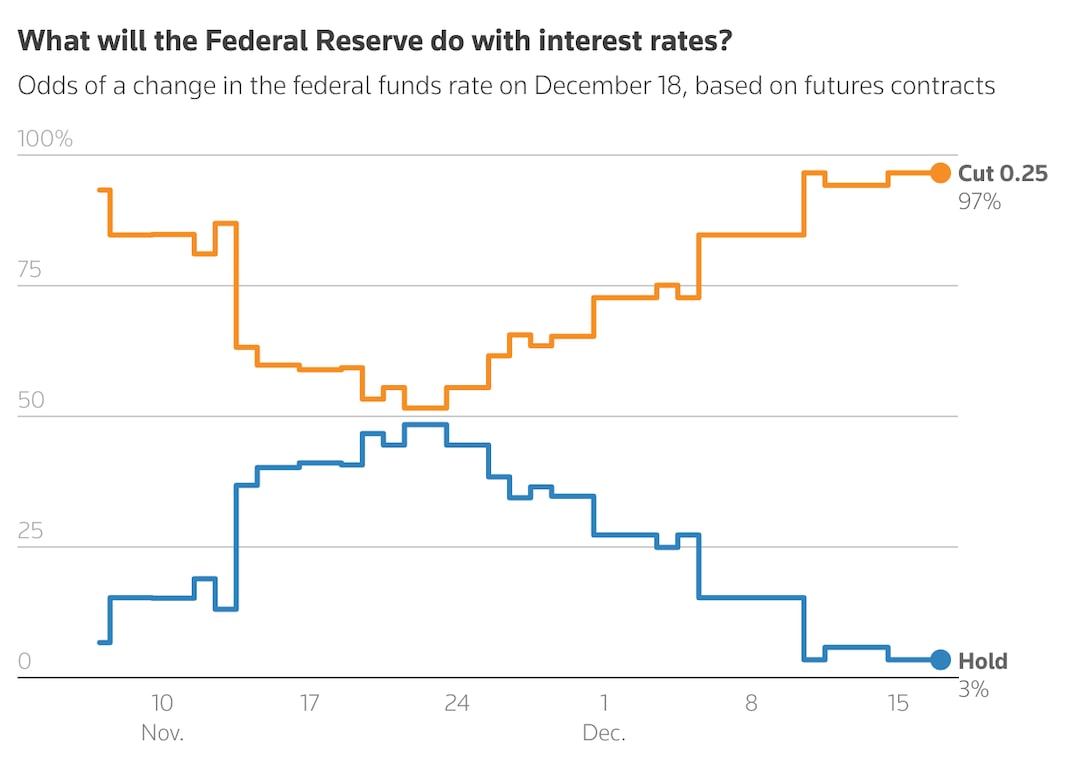

Understanding Fed Rate Cuts and Their Outlook

The Federal Reserve, often referred to as the Fed, plays a crucial role in shaping the economic landscape of the United States through its monetary policy decisions, particularly interest rate adjustments. Recent discussions and analysis surrounding the potential for Fed rate cuts in the coming years present a topic of significant interest for HR professionals and business leaders alike. This blog post will explore the outlook for Fed rate cuts, the implications they hold for businesses, and how understanding these economic shifts can lead to more informed strategic decisions.

The Current State of the Economy

As we approach 2024, the U.S. economy is showing signs of resilience amid challenges such as inflation concerns, supply chain disruptions, and an evolving labor market. Analysts and economists are closely monitoring the Federal Reserve’s approach to interest rates, particularly as inflation rates have exhibited volatility. The latest insights suggest that the Fed is likely to consider rate cuts as part of its monetary policy toolkit, especially if economic growth continues to show signs of weakening.

Predictions for Fed Rate Cuts in 2024

According to a recent article from Reuters, the Fed is expected to potentially combine interest rate cuts with a hawkish outlook for 2025. This dual approach indicates that while the Fed may adjust rates downward to stimulate economic activity in 2024, it remains vigilant about future inflationary pressures. The blend of rate cuts and cautionary measures showcases the Fed’s commitment to balancing economic growth with inflation control.

The Impact on Businesses

For HR professionals and business leaders, understanding the implications of Fed rate cuts can significantly influence decision-making processes. Rate cuts generally reduce borrowing costs for businesses, which can facilitate investments in growth initiatives, hiring efforts, and technological advancements. Consider the following benefits:

- Lower Borrowing Costs: As rates decrease, businesses may find it easier and more cost-effective to secure loans for expansion or operational needs.

- Increased Consumer Spending: With lower interest rates, consumers are more likely to spend on goods and services, driving revenue growth for businesses.

- Poor Investment Opportunities: In a lower interest rate environment, traditional savings and fixed-income investments yield lower returns, prompting businesses to seek alternative investment avenues such as technology and innovation.

Strategic Considerations for HR and Business Leaders

Given the possibility of Fed rate cuts, HR professionals and business leaders should consider several strategic adjustments:

- Investment in Technology and Innovation: As borrowing costs decline, businesses should prioritize investments in technology and innovation that drive efficiency and competitive advantage.

- Reviewing Staffing Strategies: While the economy presents opportunities for growth, HR teams should evaluate staffing strategies to ensure they align with projected business demands and economic conditions.

- Financial Modeling and Planning: It’s essential for businesses to engage in robust financial modeling that incorporates potential interest rate changes, preparing for both favorable and challenging economic scenarios.

Challenges Ahead

Despite the potential advantages of rate cuts, businesses must also remain cognizant of challenges. Inflation remains a pressing concern, and any signs of rising prices may prompt the Fed to reconsider its approach to rate cuts. Furthermore, the global economic landscape can influence local outcomes, making it essential for organizations to maintain agility in their strategic planning.

Conclusion

In summary, the outlook for Fed rate cuts in 2024 presents both opportunities and challenges for businesses. By staying informed of the Fed’s decisions and understanding the broader economic implications, HR professionals and business leaders can better navigate the evolving financial landscape. Embracing targeted strategies can empower organizations to thrive in an environment of change. Keep an eye on future developments and be prepared to adapt to ensure sustained business growth.