Exploring AMD Stock: What to Expect and Its Potential in 2025

As technology continues to evolve at a rapid pace, companies like Advanced Micro Devices (AMD) have seen their stock take considerable leaps forward. For investors and tech enthusiasts alike, understanding the trajectory of AMD stock not only informs investment strategies but provides insight into the broader tech landscape. In this blog post, we’ll delve into the current state of AMD stock, what factors could influence its future performance, and our projections for 2025.

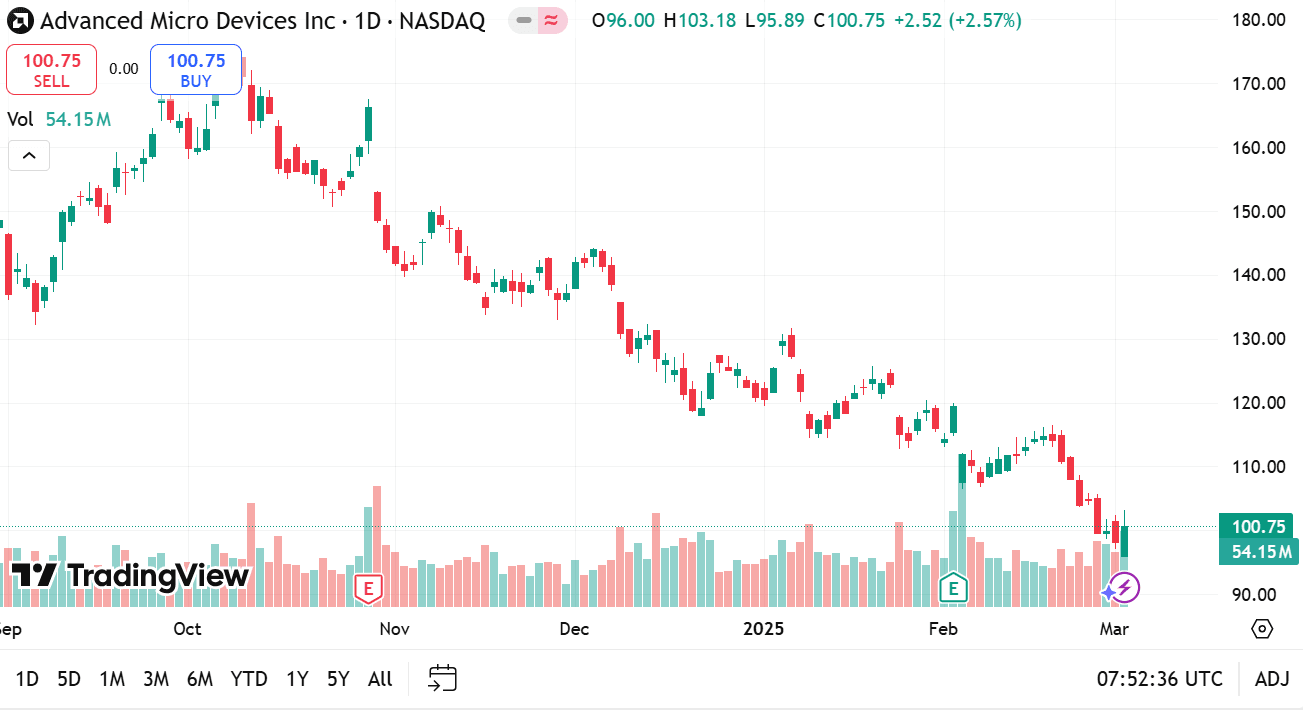

Current Overview of AMD Stock

AMD has consistently positioned itself as a formidable competitor in the semiconductor market, especially against rivals like Intel and NVIDIA. Recent years have seen AMD making remarkable strides in terms of market share and revenue growth, largely due to its innovative product lines, such as the Ryzen processors and Radeon graphics cards.

As of 2023, AMD’s stock has shown significant volatility, a common trait within the tech sector. The company’s earnings reports have generally exceeded analyst expectations, reinforcing confidence among stakeholders. According to Markets.com, latest reports highlight a bullish sentiment surrounding AMD’s stock, with projections indicating a positive trajectory in the forthcoming years.

Factors Influencing AMD’s Stock Performance

Several factors impact the performance of AMD stock. Below we’ll explore some of the most significant elements that could influence its value:

1. Product Innovation

AMD’s continuous investment in research and development leads to innovative products that cater to various market needs. The launch of new processors and graphics cards not only attracts new consumers but also retains existing customers. For instance, the introduction of the Ryzen 7000 series has garnered positive reviews for its performance and efficiency, paving the way for increased sales.

2. Market Demand

The semiconductor industry thrives on market demand. As the demand for PCs, data centers, and gaming consoles surge, AMD benefits from increased sales volume. The rising popularity of eSports and gaming is particularly noteworthy, as gamers seek high-performance hardware, notably AMD’s Ryzen and Radeon products.

3. Competitive Landscape

Intel and NVIDIA are AMD’s primary competitors. Any changes in their strategies or product offerings could potentially impact AMD’s market position. For example, if Intel successfully rolls out a groundbreaking architecture, it might affect AMD’s sales and stock outlook. Therefore, it is vital for AMD to monitor these trends closely and adjust its strategy accordingly.

4. Economic Factors

The broader economic landscape can also affect AMD stock. Economic downturns, inflation, and changing consumer spending habits all play a crucial role in shaping investor sentiment. For instance, during times of economic uncertainty, consumers may prioritize essential goods over luxury items, which could impact AMD’s sales.

Future Projections for AMD Stock

With ongoing advancements and strategic planning, what can we expect for AMD stock in 2025? Industry analysts have provided various insights based on current trends and market analysis.

According to the analysis shared on Markets.com, projections indicate a strong possibility of continued growth. By focusing on emerging technologies like AI, machine learning, and 5G, AMD is positioning itself to leverage the next wave of technological innovation. These technologies are expected to create new markets and demand for high-performance computing solutions.

Investment Strategies for AMD Stock

Investing in AMD stock requires a balanced strategy considering the potential risks and rewards. Here are several strategies for investors to consider:

1. Long-Term Investment

If you believe in AMD’s long-term vision and capabilities, holding onto the stock for several years could yield significant rewards. The tech sector often sees significant upswings in value over time, and AMD’s commitment to innovation is a solid indicator of its potential for long-term growth.

2. Dollar-Cost Averaging

This investment strategy involves investing a fixed amount of money in AMD stock at regular intervals, regardless of the stock price. This can mitigate the impacts of volatility, ensuring that you don’t invest all your capital at a peak price.

3. Analyzing Market Conditions

Paying attention to economic indicators and market conditions can help you time your investments effectively. Observing trends in the semiconductor market and broader technology sector can provide insights into when it might be advantageous to buy or sell AMD stock.

Conclusion

The future of AMD stock appears promising, driven by innovation and a strong market presence. By understanding the factors influencing its performance and aligning your investment strategies accordingly, you can navigate the exciting potential of investing in AMD. As we look towards 2025, keeping abreast of AMD’s advancements and market conditions will provide a competitive edge in making informed investment decisions.

For more detailed insights and updates on AMD stock, you can refer to Markets.com.