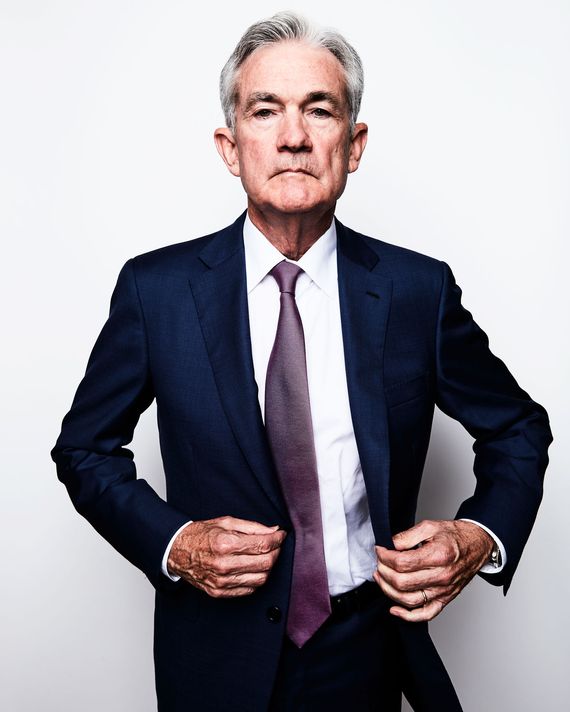

Understanding Jerome Powell

Jerome Powell has become a household name in the realm of economics, especially in understanding monetary policy and its impacts on the global market. As the current chair of the Federal Reserve, Powell’s decisions and insights shape not only the U.S. economy but also the economic landscape worldwide. This article explores Powell’s role, his approach to economic challenges, and how his leadership impacts business practices, particularly in the context of automation and AI consulting.

Who is Jerome Powell?

Jerome H. Powell, appointed as the chair of the Federal Reserve in February 2018, has navigated the central bank through turbulent economic waters, including the challenges posed by the COVID-19 pandemic. Education at Princeton University, followed by a law degree, provided him with a robust analytical foundation which he has translated into effective monetary policy. Powell’s previous roles in both the public and private sectors inform his strategies, giving him a well-rounded perspective on economic issues.

The Role of the Federal Reserve

The Federal Reserve, often referred to as the Fed, plays a crucial role in stabilizing the American economy. It manages inflation, supervises and regulates banking institutions, maintains financial stability, and provides banking services to depository institutions. Under Powell’s leadership, the Fed has emphasized transparency in its operations, adapting to the rapid changes in the economic environment. His approach to interest rates and quantitative easing aligns with the goal of ensuring liquidity in the market, particularly during crises.

Monetary Policy Decisions

One of Powell’s most notable actions was the implementation of economic measures to counteract the negative effects of the COVID-19 pandemic. The Fed’s decision to lower interest rates and introduce extensive bond-buying programs were designed to bolster the economy. The challenge lies in balancing these measures without triggering long-term inflation. Recently, Powell has signaled gradual adjustments to interest rates as the economy shows signs of recovery, which demonstrates the Fed’s commitment to adaptive monetary policy.

Impacts on Business Practices

For HR professionals and business leaders, understanding Jerome Powell’s influence on monetary policy is crucial. Interest rates directly affect borrowing costs, which impact business investments and, consequently, hiring strategies. Lower interest rates make it easier for companies to acquire funds for expansion and technology investments, such as automation tools and AI consulting services. As companies explore n8n workflows to streamline operations and reduce costs, the economic environment shaped by Powell’s policies plays a pivotal role.

The Connection to AI Consulting and Automation

In an era where efficiency is paramount, AI consulting and automation are at the forefront of transforming business processes. Jerome Powell’s decisions influence this trend, as favorable interest rates can encourage businesses to invest in technology that drives efficiency. For example, utilizing n8n workflows, organizations can automate repetitive tasks, allowing employees to focus on strategic initiatives. This shift not only improves productivity but can also lead to a more agile workforce that adapts quickly to economic changes.

Future Considerations for Businesses

As the economy evolves, businesses must remain agile. Considering Powell’s monetary policies and their implications on market conditions is vital. For HR leaders, adapting workforce strategies to align with economic forecasts can enhance organizational resilience. Utilizing automation tools such as n8n, companies can prepare for fluctuations in demand and resources, ensuring they maintain operational efficiency regardless of economic shifts.

Conclusion

Understanding Jerome Powell’s role as the chair of the Federal Reserve offers invaluable insights into economic dynamics that affect every organization. By keeping a close eye on his monetary policy decisions, businesses can make informed choices regarding investments in automation and technology. The link between economic policy and business strategy has never been more critical, and it’s clear that Powell’s influence will continue to shape these discussions for years to come. For further reading on Jerome Powell, visit New York Magazine.