Analyzing AMD Stock: What the Future Holds for Investors in 2025

As the technology sector continues to evolve and expand, many investors are turning their eyes towards major players such as Advanced Micro Devices, Inc. (AMD). As of late 2023, AMD stock remains a hot topic of conversation, especially as analysts speculate on its future performance. In this article, we will delve deep into AMD’s stock performance, key factors influencing its price, and what investors can expect by 2025.

In the world of technology investments, AMD stands out not only for its innovative products but also for its strategic positioning within the semiconductor industry. According to Markets.com, AMD has been on a growth trajectory, and understanding its stock is crucial for investors looking to make informed decisions.

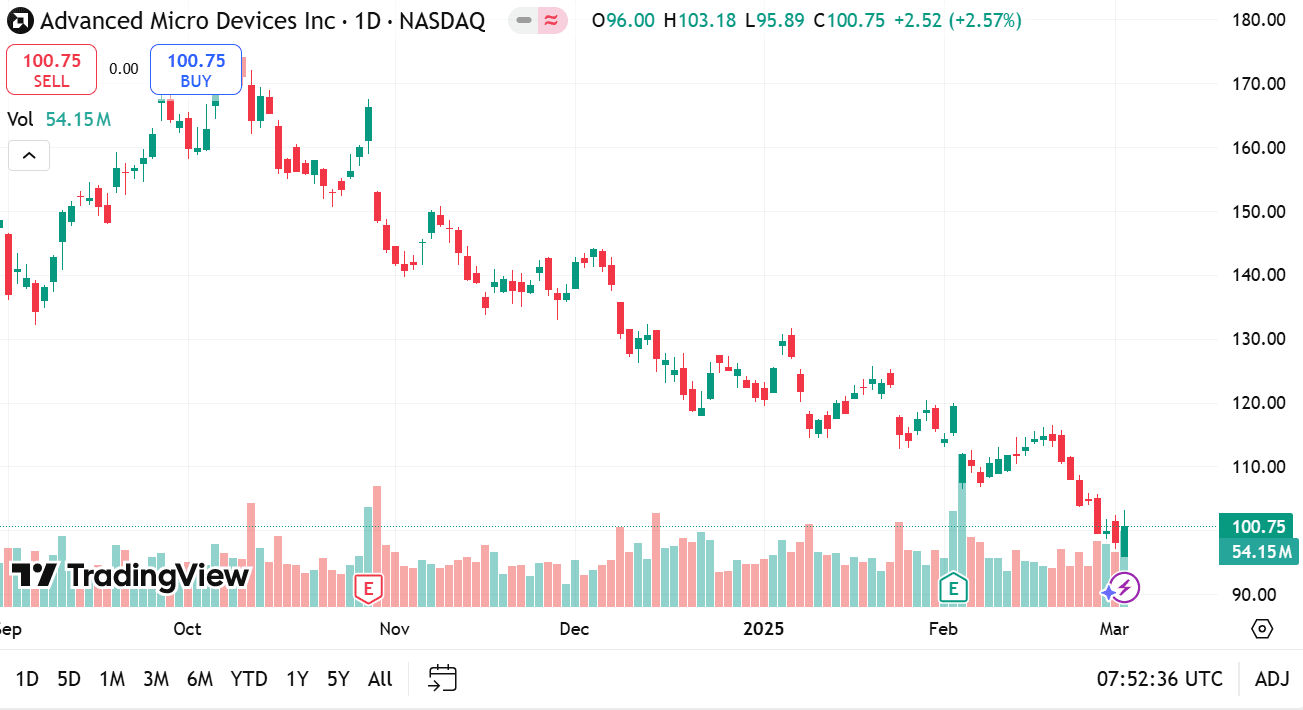

The Current State of AMD Stock

As of now, AMD’s stock has shown resilience despite the turbulent market conditions that have affected technology stocks broadly. Recent reports have indicated that AMD is navigating economic challenges through strategic partnerships and product innovation, which bodes well for its future performance. For those unfamiliar with the stock market landscape, AMD is primarily known for its CPUs and GPUs, essential components in computing and gaming devices.

Factors Influencing AMD Stock Performance

Several key factors are influencing the performance of AMD stock:

- Market Demand: The demand for processing power in gaming, artificial intelligence, and cloud computing has increased significantly. This trend drives AMD’s sales, as their hardware is critical for meeting these needs.

- Technological Innovation: AMD has constantly pushed the boundaries of technology with its Ryzen and EPYC processors. Innovations like 3D V-Cache technology improve performance and efficiency, keeping AMD competitive against giants like Intel and NVIDIA.

- Strategic Partnerships and Acquisitions: AMD’s collaboration with major companies such as Microsoft and its acquisition of Xilinx expand its capabilities and market share, ensuring steady growth.

- Economic Conditions: Economic factors, including interest rates, inflation, and global supply chain disruptions, can significantly impact stock prices. Investors need to monitor these conditions closely, as they profoundly affect tech stocks.

Investment Analysis: What to Expect by 2025

Looking ahead, several analysts predict various scenarios for AMD stock by 2025. The consensus suggests a positive outlook, driven by strong product launches and growing sectors that AMD serves. Here’s a breakdown of what investors might expect:

- Potential Stock Price Growth: Many analysts foresee AMD reaching new highs, particularly considering the expected growth in data center demand. The price forecasts for AMD by 2025 are optimistic, with estimates ranging from $100 to $250 depending on market conditions and company performance.

- Increased Market Share: As AMD continues to break into Intel’s stronghold in the CPU market, the potential for increased market share could drive revenue and stock growth.

- Profitability Enhancements: Continued enhancements in production efficiency and lower costs will contribute positively to AMD’s profit margins, thereby supporting stock price appreciation.

- Dividend Potential: While AMD hasn’t traditionally been a dividend stock, increasing profitability could lead the company to consider returning value to shareholders in the form of dividends.

Potential Risks to Consider

While the future seems bright for AMD, investors should remain aware of potential risks:

- Competitive Pressure: AMD faces stiff competition from NVIDIA in the GPU market and Intel in CPUs, which could impact market share and pricing strategies.

- Supply Chain Disruptions: The semiconductor industry has been hit by supply chain issues. Any prolonged disruptions could affect production timelines and inventory levels.

- Market Volatility: Global economic conditions can lead to volatility in stock prices. It’s crucial for investors to remain informed and agile.

Conclusion: Is AMD Stock a Buy?

For HR professionals and business leaders considering investments in the tech sector, AMD stock presents an appealing opportunity for growth. With a favorable outlook projected through 2025, driven by strong demand, innovative technology, and strategic initiatives, AMD is a stock worth considering. However, as with any investment, individuals should conduct thorough research and consider both the potential risks and rewards before making financial decisions.

As we conclude our analysis of AMD stock, we encourage readers to stay updated with market trends and developments. By doing so, investors can position themselves advantageously within the dynamic landscape of the tech industry.