Understanding the Impact of Elon Musk on Tesla Stock

In the constantly evolving landscape of technology and finance, few names resonate as strongly as Elon Musk. Known for his audacious vision and relentless drive, Musk is not only the CEO of Tesla, Inc. but also a figure who has deeply influenced market sentiments and investor confidence. In this blog post, we will explore how Elon Musk’s leadership has affected Tesla stock, analyzing the dynamics of his influence on shareholder confidence and corporate performance.

Elon Musk: The Visionary CEO

Elon Musk is often celebrated for his innovative approach to technology and business. Leading Tesla since its inception, he has transformed the electric vehicle (EV) market, positioning Tesla as a leader in the industry. His vision extends beyond just automotive; he aims to revolutionize energy consumption and transportation. Musk’s background in physics and economics underpins his strategies, giving him a unique perspective on both the engineering and financial aspects of his ventures.

The Correlation Between Leadership and Stock Performance

The link between a company’s leadership and its stock performance is a well-documented phenomenon. Investors often look to the CEO’s actions, public statements, and overall vision to gauge the potential trajectory of the company’s stock. Elon Musk’s sometimes controversial behavior, including his use of social media, has been shown to create significant fluctuations in Tesla’s stock price.

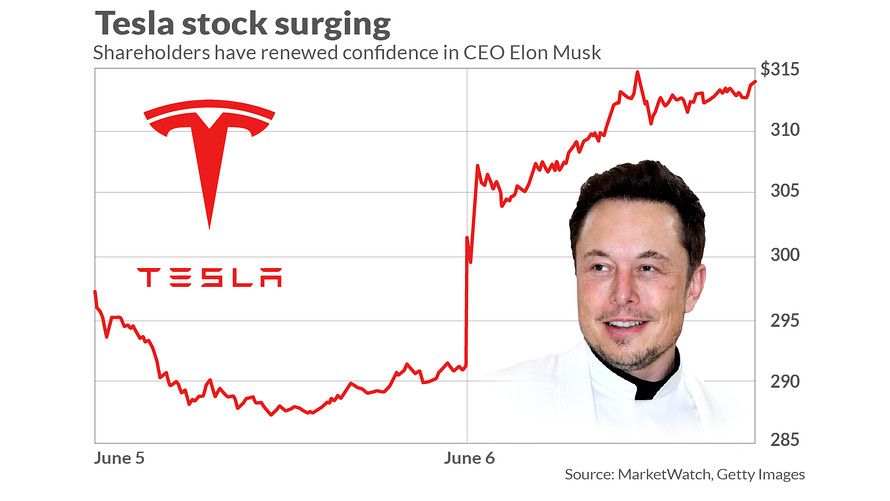

For instance, in June 2018, Tesla stock surged as shareholders showed renewed confidence in Musk’s leadership, a testament to how investors respond to the cues from the CEO. According to MarketWatch, this resurgence in stock prices was the result of Musk’s ability to effectively communicate a positive outlook for Tesla amidst production challenges.

Factors Influencing Tesla Stock Prices

Several factors influence the stock prices of Tesla, many of which are directly related to Musk’s leadership:

- Production Forecasts: Musk’s ability to meet production targets for Tesla vehicles is critically important. Investors track these forecasts closely, as production numbers directly correlate with revenue expectations.

- Innovations and Product Launches: New product announcements and technological advancements, such as Tesla’s advancements in battery technology and autonomous driving, tend to drive stock prices up. Musk’s public demonstrations of these innovations can further enhance investor sentiment.

- Market Sentiment: General market sentiment towards electric vehicles and sustainability play a role in Tesla’s stock performance. Musk’s vision for a sustainable future aligns with increasing consumer interest in eco-friendly technologies, further boosting investor confidence.

- Pivotal Moments in Leadership: Key moments in Musk’s leadership history, such as his efforts in ensuring the successful ramp-up of vehicle production during pivotal times, have affected stock volatility. For example, when Musk famously declared that he was considering taking Tesla private, it sent shockwaves through the market, showcasing the immediate impact of his words.

The Role of Media and Public Perception

The media plays a crucial role in shaping public perception of Tesla and its leadership. Musk’s bold announcements and candid remarks often make headlines, affecting stock values in real-time. While his tweets and statements can sometimes lead to controversy, they also keep investors engaged and informed about Tesla’s direction. This unique relationship with the media allows for instant reactions from shareholders, making Musk’s communication style pivotal in stock market performance.

Financial Performance of Tesla—A Quick Overview

Tesla’s financial performance has been remarkable under Musk’s guidance. The company has consistently reported increasing revenues, driven by record deliveries of its electric cars. Investors are particularly interested in quarterly earnings reports that reflect Musk’s ability to lead Tesla through both lucrative periods and challenging market conditions.

For example, in 2020, despite the global pandemic, Tesla saw its stock price soar due to strong delivery numbers and an expanded product lineup, proving that investor confidence in Musk’s vision was well-placed. The notable increase in Tesla’s market cap has made it one of the most valuable automakers in the world, further solidifying Musk’s reputation as a transformative leader.

A Future-Oriented Approach: What Lies Ahead for Tesla

Looking ahead, Tesla is poised for continued growth, thanks in large part to Musk’s strategic planning and innovation. Upcoming projects, including new factory openings in various countries, advancements in battery technology, and plans for ride-sharing services, signal a bright future for the company.

For HR professionals and business leaders, understanding Tesla’s dynamic approach under Musk provides valuable insights into effective leadership practices and market strategies related to innovation, sustainability, and change management. They can learn the importance of communicating a clear vision and maintaining transparency with stakeholders to cultivate confidence, which is essential in any fast-paced business environment.

Conclusion

In conclusion, Elon Musk’s leadership has had a profound impact on Tesla’s stock performance and overall market perception. His ability to inspire confidence among investors, coupled with a commitment to innovation and excellence, has positioned Tesla as a leader in the automotive industry.

As market dynamics continue to evolve, the relationship between leadership actions and stock prices remains an area of keen interest for investors and business professionals alike. Tesla’s journey under Musk serves as a compelling study in strategic innovation and market resilience, showcasing how visionary leadership can drive both corporate success and stock performance. Understanding these principles can equip industry leaders to navigate their own organizations through the challenges and opportunities of the future.