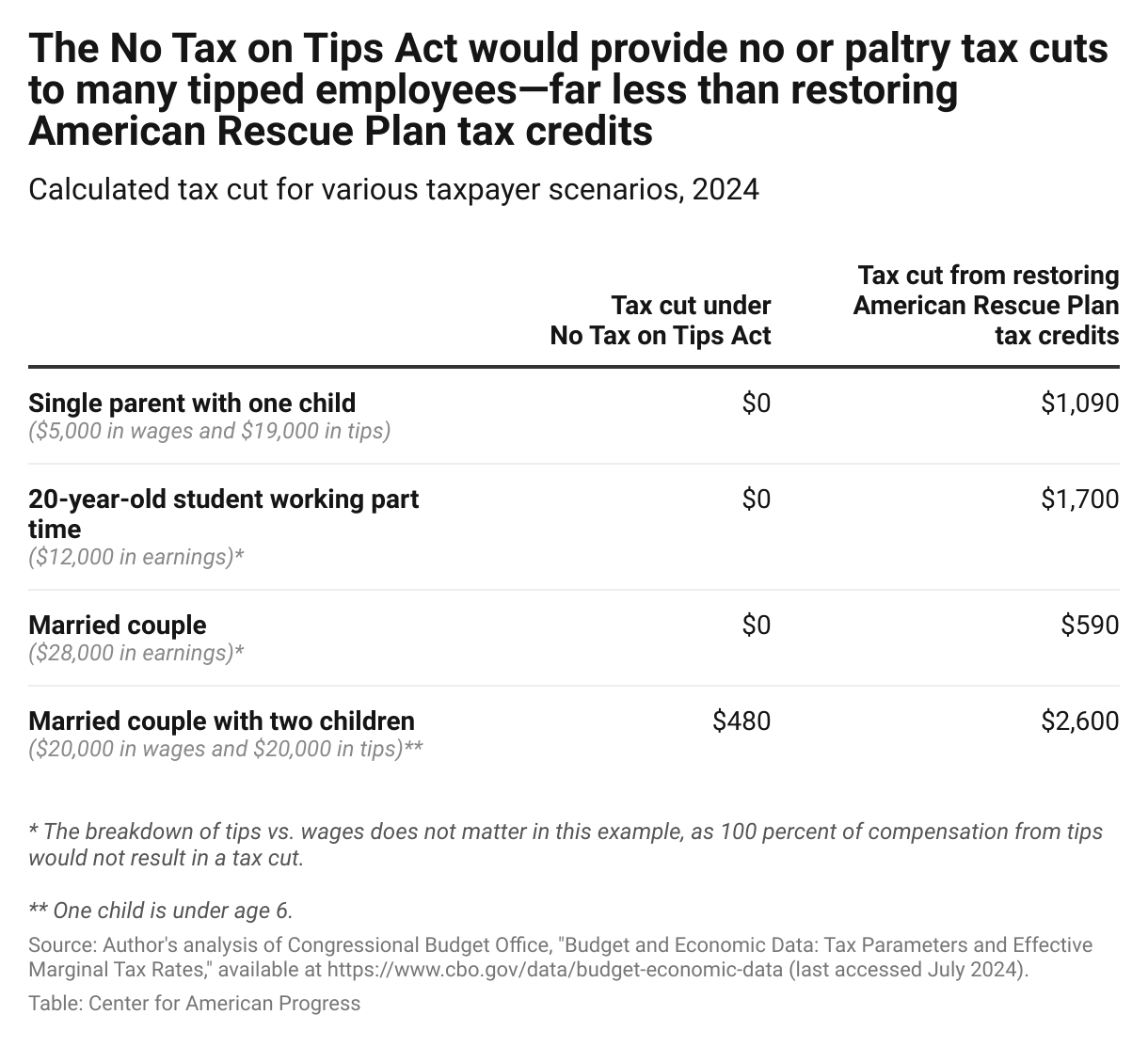

Understanding the No Tax on Tips Act: What It Means for Workers and Businesses

The No Tax on Tips Act is a pivotal piece of legislation that aims to alleviate the tax burden on service workers by prohibiting the taxation of gratuities. In industries such as hospitality and food services, tips represent a significant portion of income for many employees. This blog post delves into the implications of the No Tax on Tips Act for businesses and workers, ensuring you are informed about its benefits and consequences.

What is the No Tax on Tips Act?

The No Tax on Tips Act is a legislative proposal aimed at exempting tips from federal income tax and payroll tax. This act seeks to create a more equitable compensatory landscape for workers in sectors heavily reliant on gratuities. The support for this act comes from advocacy groups and labor representatives who argue that taxing tips undermines the financial stability of service employees.

Why is the No Tax on Tips Act Important?

1. **Economic Relief for Service Workers**: The act addresses the financial struggles of service workers who often work for lower base wages and rely on tips for a living wage. By eliminating the tax on these gratuities, workers can retain a larger portion of their earnings, thereby enhancing their economic stability.

2. **Boosting Morale and Job Satisfaction**: When workers feel valued and receive fair compensation, their job satisfaction tends to increase. The No Tax on Tips Act acknowledges the hard work and dedication of service employees, potentially leading to lower turnover rates and a more motivated workforce.

3. **Encouraging Fairness in Compensation**: The current taxation system disproportionately affects low-wage workers who rely on tips. The No Tax on Tips Act aims for a fair and equitable approach to compensation, recognizing the importance of tips in the overall wage structure.

Potential Challenges and Counterarguments

While the No Tax on Tips Act presents numerous benefits, there are also challenges and counterarguments that need to be considered.

1. **Potential Impact on Tax Revenue**: Opponents of the act argue that exempting tips from taxation could result in significant losses in tax revenue for federal and state governments. This could affect funding for public services and social programs that rely on tax income.

2. **Impact on Employers**: Some business owners express concern that no longer taxing tips may complicate payroll processing and lead to confusion regarding wage standards. Employers must adapt to new regulations, which could incur additional administrative burdens or costs.

3. **Clarity on Enforcement and Compliance**: Ensuring compliance with the No Tax on Tips Act poses a challenge. Clear guidelines must be established for both workers and employers to avoid potential disputes regarding tips and taxation.

How Will the No Tax on Tips Act Affect Businesses?

The implications of the No Tax on Tips Act extend beyond service workers and significantly impact businesses as well.

1. **Financial Implications**: By removing the tax burden from tips, businesses may experience changes in payroll calculations. Establishing clear financial practices will be essential for compliance and efficiency. Business leaders must take the proactive step of understanding the financial ramifications of this act to ensure the sustainability of their operations.

2. **Employee Relations and Retention**: Companies that embrace the No Tax on Tips Act may find themselves more attractive to potential employees. By fostering a positive work culture that recognizes and rewards service efforts, businesses can retain top talent and reduce turnover.

3. **Brand Reputation**: Organizations committed to supporting their employees actively demonstrate their values in advocating for the No Tax on Tips Act. This could enhance brand reputation and consumer trust, as more individuals align their purchasing decisions with businesses that prioritize fair labor practices.

Preparing for Changes: What Should Businesses Do?

1. **Stay Informed**: Keep abreast of developments concerning the No Tax on Tips Act. Understanding the nuances of the legislation is essential for navigating potential implementation challenges and opportunities.

2. **Communicate with Employees**: Transparency is key in all organizational changes. Businesses should openly communicate with employees regarding how the No Tax on Tips Act will impact their compensation and any adjustments in payroll practices.

3. **Consult Professionals**: Engaging with HR consultants and financial advisors will help businesses develop comprehensive plans for navigating new regulations effectively. Professional guidance can alleviate compliance burdens and ensure that operational practices align with legislative requirements.

Conclusion

The No Tax on Tips Act represents an essential step toward recognizing and supporting the workforce within service-oriented industries. By reducing financial burdens on service workers, the act promotes equity in compensation and fosters a positive environment for both employees and employers. As discussions surrounding this legislation continue, business leaders and HR professionals must remain proactive in understanding its implications for their operations.

As a part of the AI and automation landscape, integrating n8n workflows can help businesses streamline their HR processes, enhancing compliance and making data management more efficient. By staying informed and adapting to changes like the No Tax on Tips Act, companies can thrive in an evolving market while ensuring their workers are treated fairly and justly.